Online PMS Calculator

Invest in best Portfolio Management Services (PMS) to grow your wealth

Investment Amount (₹)

50L

1Cr

1.5Cr

2Cr

2.5Cr

3Cr

Investment Period (Year(s))

1Y

8Y

16Y

24Y

32Y

40Y

Returns (%)

0.5%

6%

12%

18%

24%

30%

Total Investment

₹ 10,000

Wealth Gained

₹ 1,000

Corpus Value

₹ 11,000

What Do You Mean by Portfolio Management Services (PMS)?

PMS is referred to as PORTFOLIO MANAGEMENT SERVICES. It is a sophisticated investment vehicle where the portfolio manager invests in stocks, fixed income, debt, cash, structured products and other individual securities, that can potentially be tailored to fulfil specific investment objectives. A portfolio management service gives professional management of the investments made by investor's to create wealth.

What Are the Main Features Of PMS?

Customised Investment - PMS provides a customised investment portfolio managed by professional money managers to suit the investment objective of the investor.

Diversification of Portfolio - It is one of the most important objectives of the portfolio management service. Providing proper diversification as per the necessity of investors is one of the most important aspects for any portfolio manager.

Investment/Asset Rebalancing - It is a process that nudges the portfolio towards its original objective at an annual interval. It includes the making of viable changes and retaining the asset mix that looks beneficial in the long run. The process of rebalancing helps investors to expand growth opportunities and capture gains in sectors that show high potential.

What Are the Advantages and Disadvantages Of Investing Into PMS?

ADVANTAGES OF PMS

There are many advantages of Portfolio Management Services. Some of them are:

- Higher Returns - PMS are more aggressive and have the ability to make higher returns.

- Hassle-Free Management and Continuous Monitoring - It helps In-depth research and study as well as hassle-free management and continuous monitoring of stocks, which is not possible for an individual to manage on a large scale.

- Independent Portfolios - PMS holdings vary and are not affected by other investor's actions. In general, investors tend to shop in rising markets and selling in falling markets can cause panic. It will also affect other investors. But in PMS, you are the only decision-maker.

- Accountable Managers - Unlike mutual funds, PMS managers are directly accountable to the customer who can seek justification, especially in the case of discretionary portfolios.

- Negotiable Fee - The fee for service providers is negotiable. If the portfolio is very large, investors can negotiate for a lower fee.

DISADVANTAGES OF PMS

With impressive benefits, the portfolio management service (PMS) has some disadvantages which are listed below:

- Risk of over-diversification - Sometimes portfolio managers become enthusiastic in their efforts to diversify and go beyond investment control. In such cases, the expected loss exceeds the expected profit and in the event of an accident, it can lead to serious consequences.

- No downside protection - Even though portfolio management helps reduce risks, it may not provide complete protection and turns obsolete during an accident. Moreover, midcaps and small cap-oriented PMS is riskier.

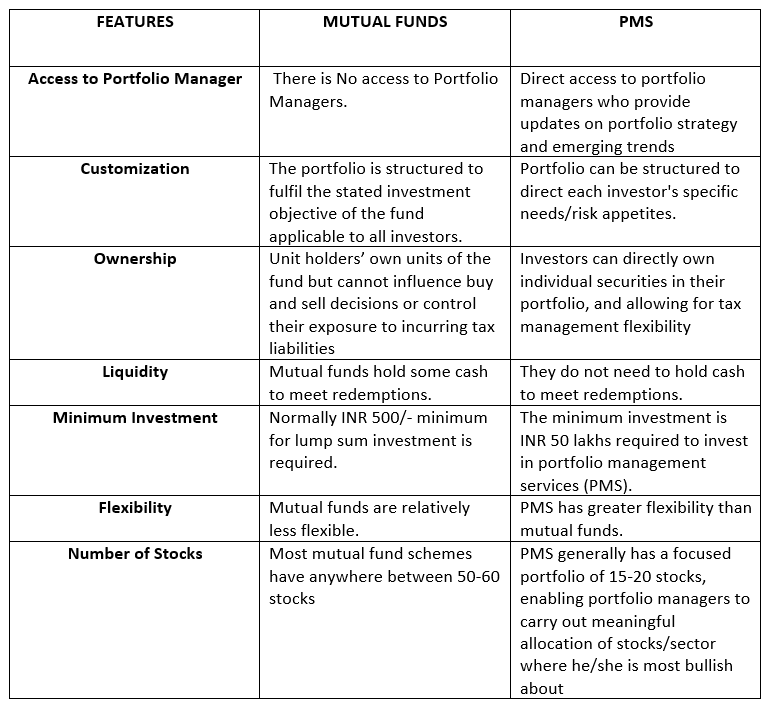

How PMS is Different from Investing into Mutual Funds?

The differences between Mutual Funds and PMS are the following:

Further Reading: